As electric demand continues to rise across multiple states, utilities face increasing pressure to enhance grid reliability while maintaining cost-effectiveness. Several factors contribute to the surge in demand, including population growth, economic expansion, the electrification of transportation, and the proliferation of high-energy-consuming industries such as data centers. In particular, the adoption of electric vehicles (EVs) and advancements in artificial intelligence (AI) technology are placing unprecedented strain on power grids. According to industry forecasts, global electricity demand is expected to grow by over 25% by 2040, with the U.S. seeing a steady rise in consumption year over year.

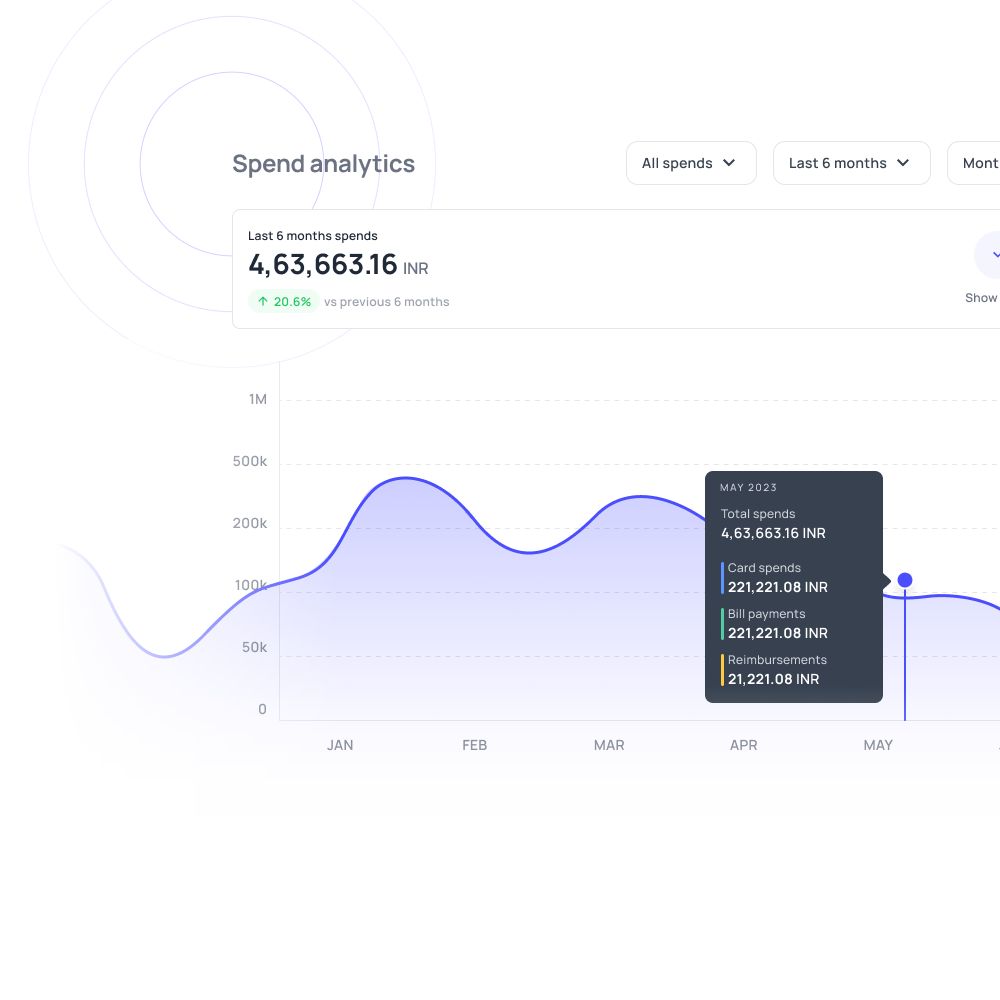

In response to these challenges, utilities must prioritize energy efficiency measures to mitigate operational costs while maintaining service reliability. While the total potential savings estimate depend on the utility’s energy mix, infrastructure, and regulatory environment, a well-executed efficiency strategy can typically result in:

- Fuel savings: 10-50%

- Maintenance & O&M savings: 15-30%

- Transmission loss reduction: 3-5%

- Carbon cost reduction: 20-50%

- Overall operational cost reduction: 10-20% annually

For a large utility generating 10,000 MW, these savings could easily translate into hundreds of millions of dollars per year.

Yet traditional methods of expanding generation capacity—such as building new power plants or upgrading transmission infrastructure—are capital-intensive and time-consuming that can make projected ROI fall by the wayside.

When considering the construction of new power plants or upgrading transmission infrastructure, utilities must be aware of several potential pitfalls and hidden costs that can make achieving a good return on investment (ROI) difficult. Here are some key factors to consider:

Capital Cost Overruns & Budget Inflation

- Construction Delays: Regulatory approvals, environmental impact assessments, and supply chain disruptions can delay projects, increasing labor and material costs.

- Material Price Volatility: Steel, concrete, and specialized electrical components can fluctuate in price, driving up project budgets.

- Labor Shortages: Skilled labor shortages in engineering, construction, and grid modernization can increase wages and extend project timelines.

Regulatory & Policy Uncertainty

- Shifting Energy Policies: Government policies regarding renewables, emissions, or deregulation may change during the project, affecting the financial viability of fossil fuel or nuclear plants.

- Permitting Delays: Lengthy federal, state, and local approval processes can add years to project timelines, delaying revenue generation.

- Evolving Environmental Standards: New emissions or land-use regulations may require costly retrofits even before a plant or transmission line is completed.

Market & Demand Risks

- Changing Energy Demand Patterns: Energy efficiency measures and demand-side management programs can reduce projected electricity demand, leading to underutilization of new infrastructure.

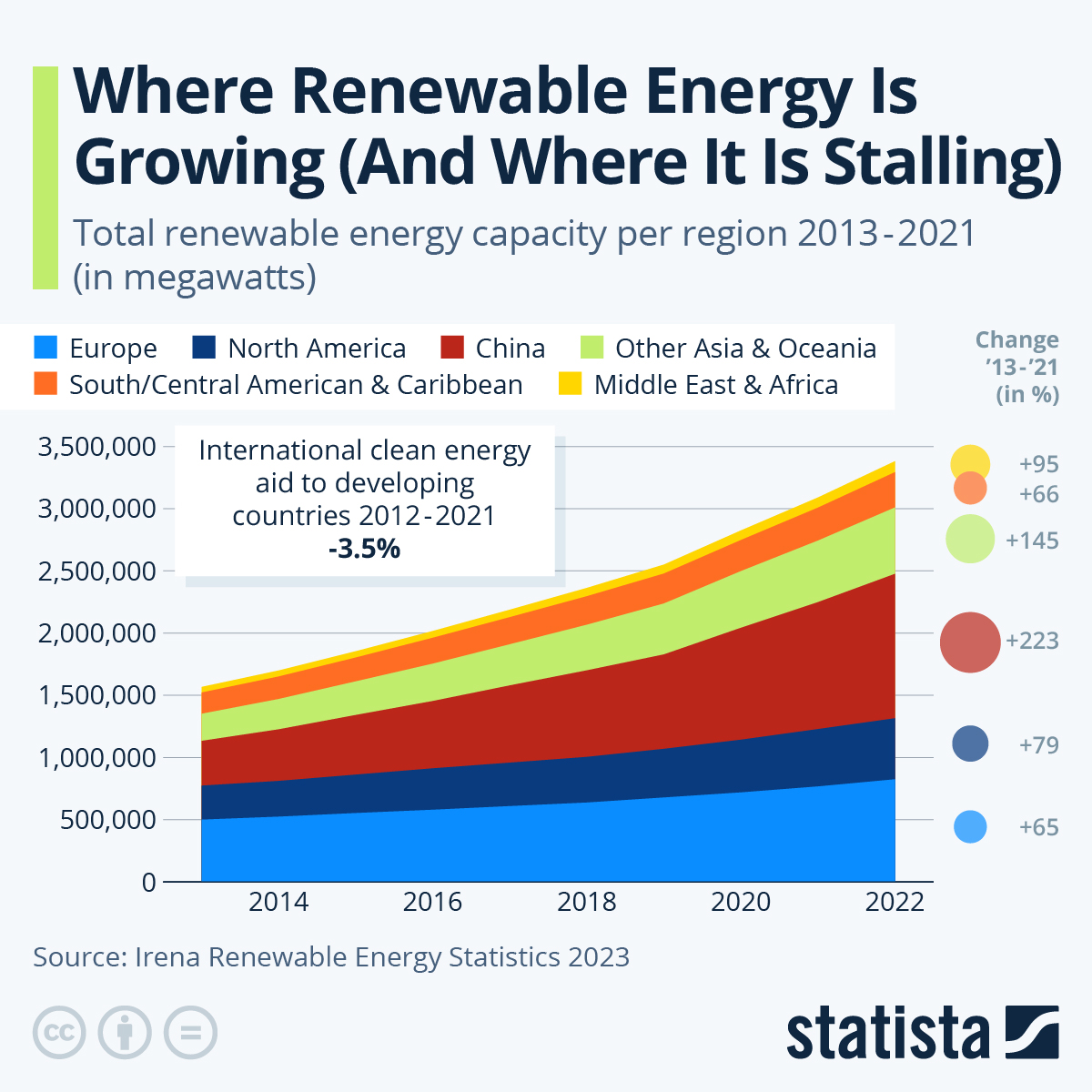

- Renewable Energy Growth & Distributed Generation: Increased adoption of rooftop solar, battery storage, and microgrids may reduce the need for large centralized power plants or transmission expansions.

- Electrification Uncertainty: While electric vehicle (EV) adoption and electrification of industries could drive demand, the pace and scale remain uncertain.

Grid Integration Challenges

- Interconnection Bottlenecks: Upgrading transmission infrastructure can be complex due to the need for coordination across multiple utilities, independent system operators (ISOs), and regulatory bodies.

- Grid Congestion & Curtailment Risks: Poor planning can lead to inefficient energy distribution, causing renewable generation to be curtailed or fossil fuel plants to run at suboptimal capacity.

- Cybersecurity & Resilience Costs: New digital grid technologies introduce cybersecurity risks that require additional investments in protection and monitoring.

Long Payback Periods & Financial Risks

- High Debt Burden & Interest Rate Risks: Large-scale projects often require significant borrowing, and rising interest rates can increase financing costs.

- Stranded Asset Risk: If market conditions shift (e.g., cheaper renewables, carbon pricing), newly built fossil fuel plants may become obsolete before reaching their expected lifespan.

- Revenue Uncertainty: Utilities may struggle to recover costs if electricity rates cannot be adjusted due to regulatory or competitive pressures.

Environmental & Social Opposition

- Community Pushback: Local resistance to power plants, substations, or transmission lines can lead to legal battles, additional mitigation costs, or even project cancellations.

- Environmental Lawsuits: Legal challenges from environmental groups regarding land use, air quality, or water use can delay or halt projects.

- Land Acquisition Challenges: Securing land or right-of-way for new infrastructure can be costly, especially if eminent domain processes face resistance.

Technological Obsolescence & Future-Proofing Issues

- Rapid Advances in Energy Technology: Battery storage, hydrogen, small modular reactors (SMRs), and other emerging technologies could make traditional infrastructure investments outdated faster than expected.

- Grid Decentralization Trends: A shift toward localized energy solutions, such as microgrids and distributed energy resources (DERs), may reduce reliance on large power plants and transmission lines.

Maintenance & Operational Costs

- Aging Workforce & Training Needs: Maintaining new infrastructure requires skilled workers, and training programs for new technologies add costs.

- Unexpected Equipment Failures: Advanced grid components and generation technologies may have unanticipated reliability issues, increasing ongoing maintenance costs.

- Weather & Climate Risks: Extreme weather events (e.g., hurricanes, wildfires, ice storms) can increase repair and resilience investment costs.

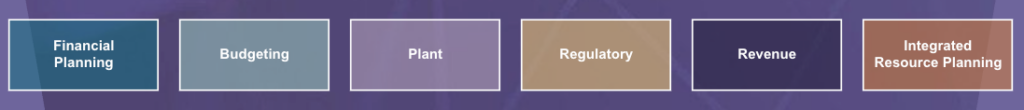

So How Do You Manage All of These Silos of Risk?

The best method is to take a unified end to end solution that incorporates all aspects of a utility’s operations including financial planning, budgeting, plant operations, regulatory, revenue and overall integrated resouce planning

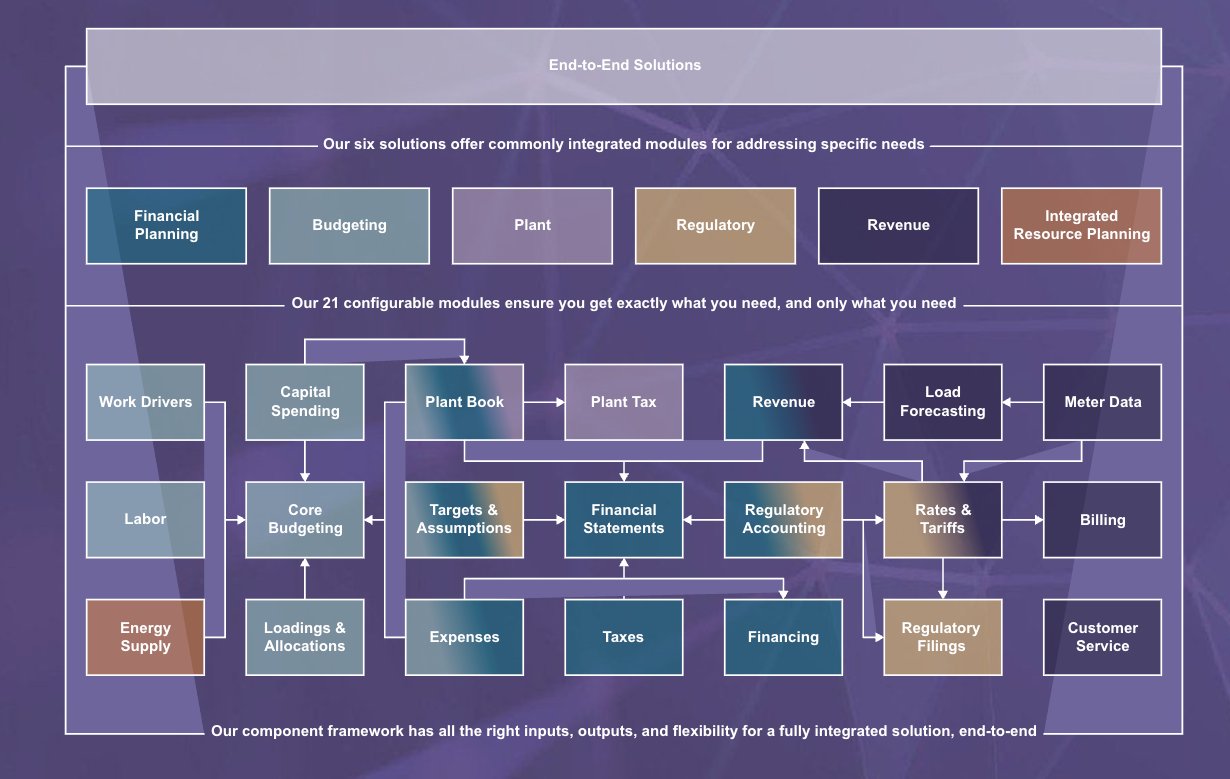

The best overall solution is a suite of utility-focused software solutions designed to enhance operational efficiency and reduce costs through energy-efficient practices.

Solutions Covering All Aspects of Utility Operations

Grid Modernization & Automation

- Advanced Metering Infrastructure (AMI): While UISG’s primary focus is on financial and operational planning, their integrated solutions can support the financial modeling and budgeting necessary for AMI deployments, ensuring cost-effective implementation.

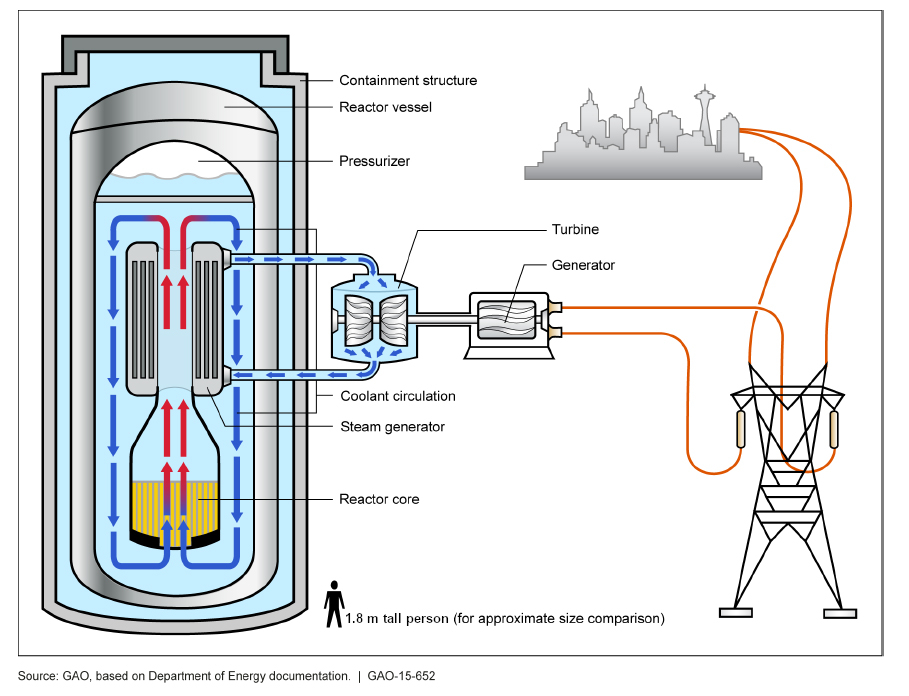

Energy-Efficient Power Generation

- Upgrading Power Plants: UISG’s Plant Solution offers tools for detailed financial planning and analysis of plant operations, aiding in identifying cost-saving opportunities through efficiency upgrades.

- Combined Heat and Power (CHP): The software facilitates modeling and financial assessment of CHP projects, enabling informed decision-making regarding their implementation.

Reducing Transmission and Distribution (T&D) Losses

- High-Efficiency Transformers & Power Factor Optimization: UISG’s solutions assist in budgeting and financial analysis for infrastructure investments aimed at reducing T&D losses, ensuring that such projects are both efficient and cost-effective.

Demand-Side Management (DSM) & Customer Programs

- Energy Efficiency Incentives: UISG’s Revenue Solution enables accurate forecasting and analysis of revenue impacts from DSM programs, assisting in the design of effective customer incentives.

- Load Control Programs: The software supports financial modeling of load control initiatives, evaluating their potential to reduce peak demand and operational costs.

Fleet and Facility Energy Efficiency

- Capital Budgeting for Upgrades: UISG’s Budgeting Solution provides a centralized platform for planning and tracking capital expenditures related to facility upgrades, such as LED lighting and HVAC optimization, ensuring alignment with financial goals.

Data-Driven Operational Efficiency

- Predictive Analytics & AI: While UISG’s software may not directly offer AI tools, it provides robust data integration and reporting features that can supply the necessary data foundation for AI-driven predictive maintenance and operational analytics.

- Energy Management Systems (EMS): UISG’s solutions can integrate with EMS platforms, offering financial and operational data to enhance overall energy management strategies.

Workforce Optimization

- Remote Monitoring & Automation: UISG’s software supports the financial planning and analysis of investments in remote monitoring technologies, evaluating their cost-benefit to optimize workforce deployment.

- AI-Assisted Dispatching: By providing detailed financial insights, UISG’s solutions aid in assessing the viability and ROI of implementing AI-assisted dispatch systems.

Regulatory & Policy Strategies

- Energy Efficiency Performance Incentives: UISG’s Regulatory Solution streamlines the preparation and management of regulatory filings, ensuring that energy efficiency initiatives comply with regulations and qualify for performance incentives.

- Carbon Credit & Renewable Energy Credits (RECs): The software assists in tracking and reporting environmental attributes, facilitating participation in carbon credit and REC markets.

By leveraging comprehensive software solutions, utilities can effectively plan, implement, and monitor energy-efficient practices, leading to significant operational cost reductions and enhanced sustainability.